We started Home for the Honeymoon because we wanted to find a creative solution to a modern day problem. Home for the Honeymoon was created with the goal of helping contemporary couples realize the big dream of owning a home more easily and efficiently.

This past Saturday we attended our first Bridal Show and would like to thank everyone at The Victoria Bridal Expo for making our first wedding show such an amazing success!!! It was so much fun to meet all of the vendors in Victoria and especially, all of the brides who are planning their nuptials for the 2012 wedding season!

Our booth came together pretty well… We must say so ourselves!!!!

For more details on Home for the Honeymoon visit our website or checkout these top 5 reasons to use Home for the Honeeymoon

Many first time home buyers toil with the idea of ’taking the plunge’ and finally purchasing a property of their own. For many the prospect of becoming a home owner is both scary and exciting all at once.

A great way to gain valuable insight into what being a first time home buyer is really like is to hear from others who’ve had a similar experience.

I asked the Stringers our past clients to share the experience of purchasing their first home and to tell me frankly what went well and what could have been better.

I learned from their answers and hope you do too!

- How long have you been in your home? 8 months

- What type of home were you looking for? Small house or townhouse

- Why did you choose to work with Christina and Patricia? They were recommended highly by friends.

- What was the biggest factor that influenced your decision to buy a home? We were tired of paying someone elses mortgage via rent. Wanted something we could invest in.

- Describe some of the things that you thought were easy about the home buying process. Actually all of it, we expected it to be really stressful but found that Patricia was so skilled and experienced that it took the scariness out of buying our first home.

- What where some of the things you found hard about it? Again, honestly the confidence we found in Patricia relieved the difficulty we thought we were going to encounter. Figuring out the timing of documents just after purchasing was the only time is was slightly confusing.

- What advice would offer someone buying their first home? Don’t expect to find the perfect home, find the perfect home for you. Every place is going to have something to deal with, it’s just a matter of what you are willing to deal with. It’s an exciting experience so breathe and go with it.

- Describe the funniest thing that’s happened to you in the purchase process. We were ‘sure’ twice that we found THE place and I didn’t want to even look at more places but with my husband and Patricia’s encouragement we looked at more and found our current home, thank God we didn’t stop at the first two because our home meets our preferences way more! Also amusing was a place we looked at that had dozens of bathtubs strewn over the property

- Describe the worst thing. Can’t think of anything negative in this process.

- What are the qualities about your home that make living there enjoyable? We are able to have our pets live with us without consent of a ‘landlord’, the forest behind our yard is beautiful, it is mostly quiet and peaceful and has a good size yard for the dogs. We are paying less a month for our mortgage than our previous rent! It’s OURS!

looking forward to having our first house one day and we are loving our first home now.

looking forward to having our first house one day and we are loving our first home now.

Here are a few things to ask your self when deliberating your readiness to take the next step towards home ownership.

1. Do you have job stability?

2. Can you stay in your new home for at least the next 5 years?

3. Are there properties on the market for you to buy that are more affordable than rent?

These are just a few of the opening questions that you’ll want to consider as you work with your real estate agent to determine what’s right for you.

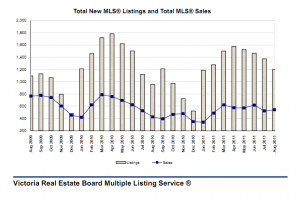

The stats are in. All in all August was a good month for real estate sales in Victoria. The median selling price on a single family home in Greater Victoria was $547, 000, the average was $652,841 and the six-month average was $621,960.

The overall average price for condominiums last month was $339,047, the six month average was $329,951 and the median was $271,500.

Sales were up from August last year with a total of 542 homes sold which is a great sign that our housing market is stable. While last month’s sales were strong overall inventory is still robust.

So what does this mean? If you’re a buyer this is a great time to get into the market. Interest rates remain low providing greater accessibility to the market place and lots of inventory means you’ve got more choices.

If you’re a seller be sure to put your best foot forward. Things like decluttering and staging your home can go a long way if you want to outperform your competition.

We are happy to announce that our listing in 365 Waterfront has sold – and we have another happy client! 365 Waterfront is one of my favorite buildings in Victoria, BC and I would recommend the development for all those buyers looking for amazing quality, an active lifestyle, and great location. Here is a video I shot on-site to introduce the building. Although our listing is now sold, I have plenty of information available about the other units listed for sale, and having worked for CONCERT properties (the developer) in the past I understand the development and know all the floorplans and features. If you would like more information about available units, pricing, and floorplans please email Christina@ChristinaCarrick.ca or call 250-857-6045.

A Bank Representative is employed by a single financial institution and is promoting that institution’s mortgage products.

A Mortgage Broker is licensed by the Province of BC and can offer the products of many different institutions including Banks, Credit Unions and Mortgage Companies. Brokers attempt to match the clients’ circumstances with the best options available from the full spectrum of lenders.

What’s a Virtual Bank?

It’s a term that has been coined to describe Mortgage Companies that do not have large public branch networks. They are Canadian Companies or Banks that may have Canadian ownership (like Canadian Western Bank) or international ownership (like ING Direct). These companies have lower overhead than many Banks and pass on the savings in the form of lower interest rates.

Mortgage Brokers often recommend these institutions to their clients to help them save money. These lenders often offer better prepayment options and lower penalties than the Banks while still providing full portability. Clients are offered the choice of one of these lenders or one of the large traditional Banks.

Some of these non-traditional lenders have been operating in Canada for 20 years or more, and have more mortgages under administration than many branch-based financial institutions. Many of these companies raise the money they lend by using the Canada Mortgage Bond program. This means that the lender pays to protect the mortgage with an insurer like CMHC. This provides an extra level of protection that isn’t always present with the large Canadian Banks.

The best advices when looking for a mortgage … carefully examine all the choices available. Meet with a mortgage professional and compare the features of mortgages offered by several different institutions. You shop carefully for your daily household needs. Shop even more carefully for your mortgage!

For more information about the benefits of working with a mortgage broker, or to meet for private consultation to assess your needs please contact Liz Prins at Liz@MortgageCanada.com or visit www.mortgagesbyliz.ca

From time to time in my travels throughout Victoria I encounter people who really stand apart form the rest. Best described as ‘Awesome’ local designer Angelique Bulosan really shines in her commitment to her craft and the happines of her clients. Creative, Chic, Classic, Funky and Environmentally Conscientious all at once isn’t easily balanced but Angelique has found the platform on which they stand in unison.

I’m not the only one who thinks so…did I mention one of her latest designs is a FINALIST for the very prestigious CARE Award! A description of Angelique’s design in her own words:

Kitchen was nominated as a finalist in the 2011 Care Awards

Kitchen

My statement about the kitchen design: The island gables play with the juxtaposition of the two finishes while thoughtfully placed stainless steel accents add to the sleek look. The “ice glass” backsplash, which was carried through the space to the beverage center’s cabinet doors, is a green product made from repurposed glass. This kitchen has all the bells and whistles boasting multiple roll out pantries, small appliance lifts, integrated tv on a swing arm concealed by a stainless steel look tambour door, built in step stool, motion sensor puck lights, three sinks – all made from a durable granite acrylic composite – coloured to match the quartz counters and the double dishwashers, fridge and freezer are concealed with integrated panels.

Remember when you looked into your mothers jewellry box for the first time? I recreated that awe and wonder for this tiny and angular powder room. The challenging shape was the foundation of my creativity.

Powder Room Cabinetry

I put extra storage in every nook and cranny I could. The space from an awkward and small hallway closet beside the powder room was used to create this vanity with extra storage tucked behind the door.

Fireplace in family room by kitchen

Fireplace in family room by kitchen

Metallic paint on the columns relates to the stainless accents and lowered costs while achieving the look I wanted. Fireplace in living room

Fireplace in living room Front Door

Front Door

I designed this custom entry way to relate to the inside renovation perfectly. The post lights up! Will post a picture of that soon!

“There was an ease to working with Angelique… she made the whole space flow together… she presented us with solutions we didn’t even think of, like how to modernize the old bay window; that part was a bonus… We love the space and feel that working with her really took the stress off of us.” – Rosalyn

During the course of this renovation I lent my design knowledge to my clients for other various parts of the house so the entire three floors and exterior would relate to each other. I had a blast working on this project and could not have asked for better clients to work with.

To connect with Angelique Bulosan and see more of her design visit http://angeliquebulosan.blogspot.com/.

Check back with us for progress on the 2011 CARE Awards.

Often times when you have purchased a new home, it can be difficult to know where to start when it comes to home decor. Which table will you buy and how will it affect the rest of the room and the furniture you already own?

Navigating the internet for usable tips on decorating your kitchen or bathroom can be overwhelming if you don’t have a lot of time.

So we thought we would do that for you!!

The following websites are the best tips online (in our opinion) for home decor –

Style at Home is a great website that provides its readers with tips and tricks as well as informative trend watching on kitchen and bathroom decor.

The website recently did an article on kitchen trends and how they are going to evolve in the future. Here is what some of their experts had to say:

“Gray will continue to be a prevalent colour in paint and in kitchen cabinets. It can be used in a traditional way with a Shaker-style front, or in very modern high-gloss applications. Gray is definitely here to stay, commonly paired with brown and white.”

Lisa Canning, Lisa Canning Interiors, Toronto

“Inspired by exotic destinations like Africa, India, Peru and Turkey we are seeing bold colours and prints in pinks, oranges, turquoise and greens. Bright colours and bold patterns paired with the classic earthy and neutral accessories create a well-balanced combination of colour for a visual feast in your home.”

The residential team of Sizeland Evans Interior Design, Calgary

In the 2011 Edition of Victoria Homes there was a very interesting article called “To Make a Successful Flip”. The article outlined some strategies and considerations that those hoping to turn a profit from purchasing a property, renovating it and then reselling it in a relatively quick time frame should keep in mind. I thought it made some really great points and wanted to share a few key tips.

- “You need to know the costs before you start.” -This is the key to every successful flip. Surprise expenses will cut into your profit margins. Having a clear picture of what renovations will cost is important but don’t forget to factor in the costs of carrying a property until it sells and the dispersal fees as well. Have your REALTOR® go over all the costs associated with the transaction on both ends with you. This will allow you to budget for things like property transfer tax and whether or not there are any exemptions that apply to you.

2. “Get to know the neighbourhood. In the end the smallest house in a more desirable area will sell for more than a larger house in a bad one.” – The golden rule of real estate: location, location, location. Especially in the case of a flip because you don’t want to be stuck with a property that will take a long time to sell or will force drastic price reductions. Both a long selling time and reduction in sales price will eat into your profits.

2. “Get to know the neighbourhood. In the end the smallest house in a more desirable area will sell for more than a larger house in a bad one.” – The golden rule of real estate: location, location, location. Especially in the case of a flip because you don’t want to be stuck with a property that will take a long time to sell or will force drastic price reductions. Both a long selling time and reduction in sales price will eat into your profits.

3. “Invest some time and money staging your home for sale.” – This is an especially important tip given the current market environment. You’ve invested time and money (and if you’ve done some of the work yourself: sweat and tears too) into this project and as mentioned above you need it to sell as quickly as possible to realize maximum profitability. While it’s my belief that staging will not necessarily get you higher offers it will help your property outperform the other product on the market which ultimately leads to a quicker sale.

3. “Invest some time and money staging your home for sale.” – This is an especially important tip given the current market environment. You’ve invested time and money (and if you’ve done some of the work yourself: sweat and tears too) into this project and as mentioned above you need it to sell as quickly as possible to realize maximum profitability. While it’s my belief that staging will not necessarily get you higher offers it will help your property outperform the other product on the market which ultimately leads to a quicker sale.

Beyond the tips mentioned here the article had a plethora of helpful information. For a tailored project specific analysis of the costs and viability of your flip contact us today.

Here is a little home purchasing advice for our readers from a great real estate website and blog called The Red Pin.

The writer is Joe Ragona and we think he is giving great advice!

A novice real estate investor may think the only way to make a profit on their investment is in buying low and selling high – appreciation … and although this is a definite way many investors make money, it’s not the only one.

If you are only buying Real Estate with the intention of it going up in value, you will eventually pay the price when markets correct, as so many have learned these past few years … especially in Alberta. Yes, you can make money if you get lucky in a hot market, but also lose just as much on the other side.

However, if you approach your investment from the long term growth side, making sure you buy a self-sustaining property with cash flow after all expenses and a buffer built in, you will benefit from the compounding growth in the long run.

This is the reason I personally don’t panic when markets correct or fluctuate. My properties still bring in cash flow while the debt continues to shrink. Sure it may be worth less than last year but who cares, I have no intention of selling today or even tomorrow anyway.

Buying for long term and in the correct market gives you four income streams:

Positive monthly cash flow

Mortgage loan reduction

Tax advantages / deductions

Appreciation

My intention is to never sell my properties, but if one day the market does decide to throw me a bone, you never know, I might catch it!

Mr. Ragona makes a good argument for the buy and hold strategy that is sometimes over looked by real estate investors.

I myself am a fan of this approach if it fits with the overall investment strategy of the individual and if the investor has a long enough time horizon.

Contact us for a free personalize portfolio review and more information on real estate investment strategies.

I came across this great article that explain what title insurance is. The article is informative and easy to understand. We will have a lawyer comment further so stay tuned and in the mean time contact us with your questions. Click on the image to read further.