One of the best ways to learn about something is to speak to others who have had a similar experience. As full service real estate agents we walk our clients through any number of situations and are available throughout the entire home sale and purchase process but it’s helpful to know what effort, time, emotions and thoughts people encounter . If you’re just at the very beginning of a real estate transaction below is a taste of what it’s really like when looking for the right home.

I asked Mr. K. Ng one of our past clients to share his home purchase experience and to tell me frankly what went well and what could have been better.

I learned from his answers and hope you do too!

1. How long have you been in your home? 8 Months

2. What type of home were you looking for? Condo

3. Why did you choose to work with Christina and Patricia? Christina and Patricia are both competent, patient and are always up for the challenge. When I have a difficult question they did not turn their back or convince me that it’s not important, they did the proper research and get back to me with an answer. This speaks value.

4. What was the biggest factor that influenced your decision to buy a home? Investment

5. Describe some of the things that you thought were easy about the home buying process. MLS listing provide statistics on the market and price difference in locations.

6. What were some of the things you found hard about it? Negotiation, because a fair price value for both the seller and the buyer is difficult to establish.

7. What advice would you offer someone buying their first home? Do extensive research, do not over look the obvious due to emotions.

8. Describe the funniest thing that’s happened to you in the purchase process. A fridge was missing from one property.

9. Describe the worst thing. Nothing, overall a very pleasant experience.

10. What are the qualities about your home that make living there enjoyable? Excellent location,walking distance to work, shops, and groceries. Water view and height ceiling.

Here are my top 4 tips for a first time buyer taking steps to get ready to buy their first home!

1. Get Informed – learn about home ownership and whether it`s right for you. Some great resources are available at CMHC (Canadian Mortgage and Housing Corporation) PLUS I we are always available to take you out for coffee to talk more about the realities of home ownership and the steps involved just email, tweet, facebook or call!`

2. Talk to your bank or mortgage broker (or both) – setting your budget is key. Brokers and bankers are very helpful in teaching you about mortgages and coaching buyers through the process of applying for a loan. For a list of pre screened brokers and bankers at all major banks in Victoria just get in touch.

3. Find a good Realtor to represent you, and help in your search – Realtors are key in the buying process, we educate buyers about the current market, show properties, answer all questions about available properties, negotiate the sale, do all the paperwork, and help ever step of the way. I always encourage clients to interview their Realtor and I will make sure to post some great interview questions soon. If you want a copy of them early then just email, tweet, facebook or call.

4. Start shopping!! – this is the FUN part and can be a long process or a relativity quick one depending on the buyers needs and personality.

If you have any questions we`re always available and happy to connect.

Earlier this week there was an article published in the Scotsman Guide discussing down payment wedding registries as a tool for couples wanting to register for a financially responsible wedding gift-sorry silver gravy boats.

We received some feedback from mortgage broker Jason Roy of The Mortgage Group Canada Inc. and of Philip Bisset-Covaneiro of Investors Group Financial Services Inc. with some great strategies on what to do with your down payment registry funds once they are all collected.

Jason Roy, the Mortgage Group Canada Inc. - The best part about a down payment registry is that having the gifted funds for your down payment gives you options. If you already have money saved up to purchase your first home, these new funds can help you to perhaps move up from purchasing a condo to being able to afford to purchase a house. If you do not have any money saved for a down payment this just may be the way to collect the minimum you need to get into the housing market. Or perhaps you have some money saved up (if you have not spent it all on the wedding) and you just need a bit more to top you up. Really the options are endless when you factor in possible lender cash back options that can be combined with the funds received through homeforthehoneymoon.com.

Talk to homeforthehoneymoon.com and talk to your local accredited mortgage professional to find out how you can turn the money received from your down payment registry into home ownership.

Home for the Honeymoon clients have raised thousands of dollars towards the purchase of their homes. In some cases, just as Jason mentioned, couples were able to buy a more valuable property than if they hadn’t used the registry. Sometimes however couples aren’t ready to purchase their homes right away and need to take some time to plan. In this case Philip offered some great strategies on what to do with your cash until you are ready to buy.

Philip Bisset-Covaneiro, Investors Group Financial Services Inc. - With respect to what to do with your money and the most strategic place to keep money I offer the following advice: keeping your options open is a must!

The worst possible situation is to plan on purchasing a home in 5 years and then having the perfect place come available in three years. Not having access to your funds because they are tied down by fees and tax regulations would inhibit your ability to proceed with the purchase of this great home. Consider the following brackets when saving for a home: use your TFSA room first followed by the First Time Home Buyer’s Program through your RRSP’s.

Tax Free Savings Accounts, although they are relatively poorly named can hold your money, fee free, and relatively risk free or completely exposed in the stock market, the choice is yours. However the limit is $15,000 as of January 2011 for everyone in Canada over the age of 18. That is also per couple. So your first $30,000 should be placed in your personal TFSA’s and then consider using the First Time Home Buyer’s Program. The limit in RRSP’s has now been increased to $25,000 per person. This now allows you to be relatively tax efficient and flexible on your first $80,000 of savings. There are time sensitive requirements for deposits made into your RRSP and when you need to redeem them during the home buying process so please work closely with your Financial Planner to both save and pick the right investments, but often what is even more importantly is to properly manage the time requirements and initial structure of the tax saving vehicles you chose.

Some great strategies from two highly accredited industry professionals. Click here to contact Jason Roy for a free mortgage consultation or click here to contact Philip Bisset-Covaneiro for more financial planning strategies.

With so many for sale signs in our neighbourhoods and some lingering on lawns longer than others many sellers wonder; are we in a buyer’s market?

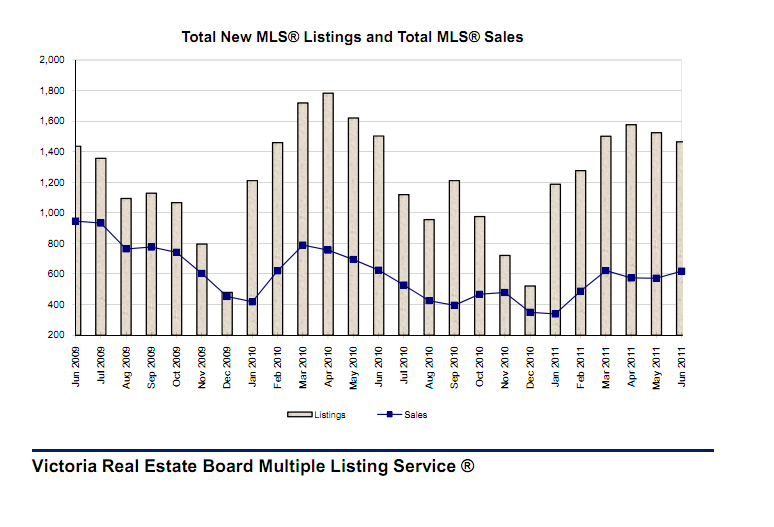

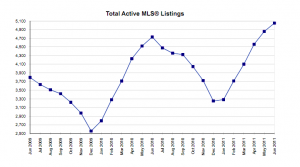

Actually market activity is more to the tune of a balanced market. In June, 618 homes and other properties were sold through the Multiple Listing Service — up from 572 sales in May and comparable to the 625 sales during June last year.

The Times Colonist published Tuesday July 4th, 2011 that the Victoria Real Estate Board inventory levels are currently seven per cent higher than they were at this point last year, and June’s 5,050 listed properties marked the highest monthly level in 15 years. This doesn’t mean that properties aren’t selling however this just means that there is more selection in inventory and that properties priced right will continue to attract buyers.

In the TC article Board President Dennis Fimrite affirmed that “In fact sales [in June] were stronger than in any other month this year. And the fundamentals in Victoria are so strong in that there is great weather, a good economy if prices start to soften you might see more buyers coming in or people buying property as investments.”

Firmrite also assured that even thought Royal Bank and TD raised their 5 yr fixed interest by 0.15 percent that market activity should remain healthy. “Yes, if rates go up it makes things less affordable, but there are a lot of people looking around who may buy because rates are going up.”

What all if this means to the home seller is that being competitive is important. With so much choice on the market making sure your property shows well is important. Turn on all the lights when you have a showing booked and of course make sure to de-clutter. If your property could use some elements like furniture in an empty space or complimentary decor consider staging.

Contact us for to have arranged an in home consultation to determine the value of your property and tips that will make you more competitive in today’s market.

Since as early as the 1930’s, many Victoria homes have used home heating oil as their primary heating source. The oil has been, and continues to be stored in large storage tanks, which are either located above ground (typically in a basement) or below ground (typically buried in a backyard). This discussion will focus on the potential problems posed by oil tanks buried below ground.

As home owners switch from using heating oil to alternative sources like electric and natural gas, many of the underground oil tanks have been emptied out and forgotten. These tanks are however a potential source of contamination of both soil and groundwater, and for that reason they are regulated by British Columbia’s Environmental Protection Act and the regulations thereto (the “Act”).

Who faces liability under the Act? Potentially, each of the current owner of the property, any prior owners of the property, and anyone who may have transported contaminants either onto the property or from the property onto another property may be liable to remediate the contaminated soil. The costs of remediating the soil can be significant; remediation of contaminated soil on a standard size City of Victoria lot could range up to $200,000 or more, depending on the level of contamination.

In addition, the owners of lots with buried underground oil tanks may face other problems, principally that the property may become uninsurable, because of the potential fire hazard posed by these buried tanks, and that banks and credit unions may not want to grant a mortgage over the property, because of the risk of contamination and the associated costs to clean it up.

With these concerns in mind, what can home owner and potential buyers do to protect themselves? The best thing to do would be to have an approved inspector check for a buried underground oil tank and, if one is found, contact individuals approved to determine the extent, if any, of any contamination, and to subsequently decommission and/or remove the tank from the property. Ascertaining whether or not there is a buried oil tank should also be part of the due diligence involved in the house-buying process; either the potential buyer and/or Realtor should find out if there is such a tank or, if the sellers do not know, then the potential buyer’s Realtor should ensure that the purchase is conditional upon the results of an inspection for such a tank.

This discussion of underground oil tanks is intended only as a brief introduction to the subject. Should you have any questions or concerns with respect to this or any other aspect of real estate law, please contact

Brendan Piovesan at Mullin DeMeo, at brendan@mdlawcorp.com, or (250) 477-3327.

An EnerGuide rating shows a standard measure of your home’s energy performance. It shows you (and future buyers) exactly how energy efficient your home is.

The rating is calculated based on standard operation assumptions so that you can compare the energy performance of one house against another.

The home’s energy efficiency level is rated on a scale of 0 to 100. A rating of 0 represents a home with major air leakage, no insulation and extremely high energy consumption.

A rating of 100 represents a house that is airtight, well insulated, sufficiently ventilated and requires no purchased energy on an annual basis (National Resource Canada)

Luckily this home at 1270 Oceanwood in Victoria BC is rated 85 and is a ‘built green platinum’ home – meaning it’s super efficient and available for sale for $895,000. More info here.

Vancouver, BC – June 30, 2011.

The British Columbia Real Estate Association (BCREA) released its 2011 Second Quarter Housing Forecast today. BC Multiple Listing Service® (MLS®) residential sales are forecast to increase 5 per cent from 74,640 units in 2010 to 78,200 units this year, before increasing a further 3.1 per cent to 80,700 units in 2012.

“Home sales will post some modest gains over the next two years,” said Cameron Muir, BCREA Chief Economist. “However, positive housing fundamentals like job growth, rising wages and an expanding population base will be somewhat offset by higher borrowing costs over the next eighteen months.”

“Following a decade where unit sales broke all records, consumer demand over the next few years will be relatively moderate,” added Muir. The ten-year BC MLS® residential sales average is 87,000 units. A record 106,300 MLS® residential sales were recorded in 2005.

Chelsea is one of Concert Properties newest concrete and steel condos in beautiful Victoria. Concert is one of Canada’s most decorated developers and this building reflects the developer’s commitment is quality. Chelsea is a low rise building with an intimate collection of only 66 homes, and is located in Fairfield at 999 Burdett.

The building seamlessly integrates with the character of the neighborhood, and is surrounded a beautiful heritage brick wall. The majority of the suites offer 2 bedrooms and a den. This is truly one of Victoria’s most desirable condominiums, and the perfect choice for those looking to downsize and simplify their life. For up to date pricing, and availability in the building please get in touch.

Green building and renovations is an emerging trend in the real estate industry and, in my opinion a very exciting and important one. I wanted to share with you a few interesting statistics about the what it means to be GREEN, and what the benefits are!

1. 62% of Canadians are willing to pay between $5000 and under $20,000 for green features, while 8% of respondents are willing to spend over $20,000 or more of a green home. (Royal Lepage/NAGAB Eco Home Survey)

2. The most popular green modifications that poll respondents already implement in their homes include switching from regular light bulbs to CFL light bulbs (74%). (Royal Lepage/NAGAB Eco Home Survey)

3. Almost 3/4 of Canadians (72%) say that they will look for a green-improved property in their next home purchase, and 63% will be willing to pay more for an environmentally friendly home. (Royal Lepage/NAGAB Eco Home Survey)

Installing renewable energy sources to a residence is very site specific and can be thought of as buying 25 years of energy up-front as opposed to the current pay-as-you-go system we are currently accustomed to. Although there are systems available which allow households to harness sunshine, wind and flowing water ( micro hydro) there are 2 essential elements to consider: On-Grid or Off- Grid?

On-Grid systems allow a house hold to produce it’s own energy with the added advantage of pushing energy back onto the grid. There are 2 kinds of on-grid systems. Grid Intertie without batteries and Grid Intertie with batteries.

Grid Intertie without batteries are the simplest systems. They work just like any other appliance in your home – with the notable exception that they create electricity and push it backwards into the power grid. These systems are extremely scalable and flexible.

Grid Intertie with batteries add storage. These energy systems have reserves that will operate when the grid goes down. They also allow flexibility in terms of buying and selling power at different times of the day (to take advantage of time of use electricity metering).

While the costs to install such systems are still high this will change over time. Many believe the investment now will pay off in the future as energy costs increase. Companies like Energy Alternatives Ltd design, supply or install alternative or complementary power systems tailored to specific sites and clients’ needs.

Check back soon for information on off-grid alternative energy systems.