I came across this great article that explain what title insurance is. The article is informative and easy to understand. We will have a lawyer comment further so stay tuned and in the mean time contact us with your questions. Click on the image to read further.

One of the best ways to learn about something is to speak to others who have had a similar experience. As full service real estate agents we walk our clients through any number of situations and are available throughout the entire home sale and purchase process but it’s helpful to know what effort, time, emotions and thoughts people encounter . If you’re just at the very beginning of a real estate transaction below is a taste of what it’s really like when looking for the right home.

I asked Mr. K. Ng one of our past clients to share his home purchase experience and to tell me frankly what went well and what could have been better.

I learned from his answers and hope you do too!

1. How long have you been in your home? 8 Months

2. What type of home were you looking for? Condo

3. Why did you choose to work with Christina and Patricia? Christina and Patricia are both competent, patient and are always up for the challenge. When I have a difficult question they did not turn their back or convince me that it’s not important, they did the proper research and get back to me with an answer. This speaks value.

4. What was the biggest factor that influenced your decision to buy a home? Investment

5. Describe some of the things that you thought were easy about the home buying process. MLS listing provide statistics on the market and price difference in locations.

6. What were some of the things you found hard about it? Negotiation, because a fair price value for both the seller and the buyer is difficult to establish.

7. What advice would you offer someone buying their first home? Do extensive research, do not over look the obvious due to emotions.

8. Describe the funniest thing that’s happened to you in the purchase process. A fridge was missing from one property.

9. Describe the worst thing. Nothing, overall a very pleasant experience.

10. What are the qualities about your home that make living there enjoyable? Excellent location,walking distance to work, shops, and groceries. Water view and height ceiling.

Earlier this week there was an article published in the Scotsman Guide discussing down payment wedding registries as a tool for couples wanting to register for a financially responsible wedding gift-sorry silver gravy boats.

We received some feedback from mortgage broker Jason Roy of The Mortgage Group Canada Inc. and of Philip Bisset-Covaneiro of Investors Group Financial Services Inc. with some great strategies on what to do with your down payment registry funds once they are all collected.

Jason Roy, the Mortgage Group Canada Inc. - The best part about a down payment registry is that having the gifted funds for your down payment gives you options. If you already have money saved up to purchase your first home, these new funds can help you to perhaps move up from purchasing a condo to being able to afford to purchase a house. If you do not have any money saved for a down payment this just may be the way to collect the minimum you need to get into the housing market. Or perhaps you have some money saved up (if you have not spent it all on the wedding) and you just need a bit more to top you up. Really the options are endless when you factor in possible lender cash back options that can be combined with the funds received through homeforthehoneymoon.com.

Talk to homeforthehoneymoon.com and talk to your local accredited mortgage professional to find out how you can turn the money received from your down payment registry into home ownership.

Home for the Honeymoon clients have raised thousands of dollars towards the purchase of their homes. In some cases, just as Jason mentioned, couples were able to buy a more valuable property than if they hadn’t used the registry. Sometimes however couples aren’t ready to purchase their homes right away and need to take some time to plan. In this case Philip offered some great strategies on what to do with your cash until you are ready to buy.

Philip Bisset-Covaneiro, Investors Group Financial Services Inc. - With respect to what to do with your money and the most strategic place to keep money I offer the following advice: keeping your options open is a must!

The worst possible situation is to plan on purchasing a home in 5 years and then having the perfect place come available in three years. Not having access to your funds because they are tied down by fees and tax regulations would inhibit your ability to proceed with the purchase of this great home. Consider the following brackets when saving for a home: use your TFSA room first followed by the First Time Home Buyer’s Program through your RRSP’s.

Tax Free Savings Accounts, although they are relatively poorly named can hold your money, fee free, and relatively risk free or completely exposed in the stock market, the choice is yours. However the limit is $15,000 as of January 2011 for everyone in Canada over the age of 18. That is also per couple. So your first $30,000 should be placed in your personal TFSA’s and then consider using the First Time Home Buyer’s Program. The limit in RRSP’s has now been increased to $25,000 per person. This now allows you to be relatively tax efficient and flexible on your first $80,000 of savings. There are time sensitive requirements for deposits made into your RRSP and when you need to redeem them during the home buying process so please work closely with your Financial Planner to both save and pick the right investments, but often what is even more importantly is to properly manage the time requirements and initial structure of the tax saving vehicles you chose.

Some great strategies from two highly accredited industry professionals. Click here to contact Jason Roy for a free mortgage consultation or click here to contact Philip Bisset-Covaneiro for more financial planning strategies.

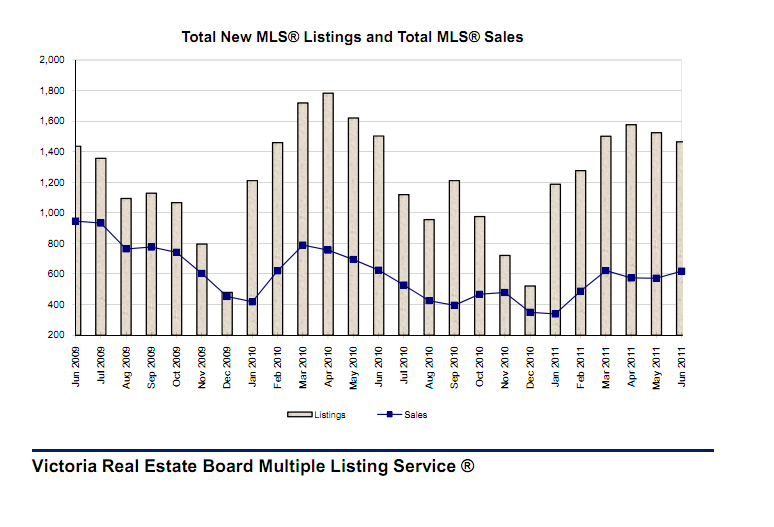

With so many for sale signs in our neighbourhoods and some lingering on lawns longer than others many sellers wonder; are we in a buyer’s market?

Actually market activity is more to the tune of a balanced market. In June, 618 homes and other properties were sold through the Multiple Listing Service — up from 572 sales in May and comparable to the 625 sales during June last year.

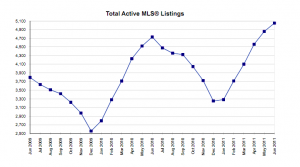

The Times Colonist published Tuesday July 4th, 2011 that the Victoria Real Estate Board inventory levels are currently seven per cent higher than they were at this point last year, and June’s 5,050 listed properties marked the highest monthly level in 15 years. This doesn’t mean that properties aren’t selling however this just means that there is more selection in inventory and that properties priced right will continue to attract buyers.

In the TC article Board President Dennis Fimrite affirmed that “In fact sales [in June] were stronger than in any other month this year. And the fundamentals in Victoria are so strong in that there is great weather, a good economy if prices start to soften you might see more buyers coming in or people buying property as investments.”

Firmrite also assured that even thought Royal Bank and TD raised their 5 yr fixed interest by 0.15 percent that market activity should remain healthy. “Yes, if rates go up it makes things less affordable, but there are a lot of people looking around who may buy because rates are going up.”

What all if this means to the home seller is that being competitive is important. With so much choice on the market making sure your property shows well is important. Turn on all the lights when you have a showing booked and of course make sure to de-clutter. If your property could use some elements like furniture in an empty space or complimentary decor consider staging.

Contact us for to have arranged an in home consultation to determine the value of your property and tips that will make you more competitive in today’s market.

Installing renewable energy sources to a residence is very site specific and can be thought of as buying 25 years of energy up-front as opposed to the current pay-as-you-go system we are currently accustomed to. Although there are systems available which allow households to harness sunshine, wind and flowing water ( micro hydro) there are 2 essential elements to consider: On-Grid or Off- Grid?

On-Grid systems allow a house hold to produce it’s own energy with the added advantage of pushing energy back onto the grid. There are 2 kinds of on-grid systems. Grid Intertie without batteries and Grid Intertie with batteries.

Grid Intertie without batteries are the simplest systems. They work just like any other appliance in your home – with the notable exception that they create electricity and push it backwards into the power grid. These systems are extremely scalable and flexible.

Grid Intertie with batteries add storage. These energy systems have reserves that will operate when the grid goes down. They also allow flexibility in terms of buying and selling power at different times of the day (to take advantage of time of use electricity metering).

While the costs to install such systems are still high this will change over time. Many believe the investment now will pay off in the future as energy costs increase. Companies like Energy Alternatives Ltd design, supply or install alternative or complementary power systems tailored to specific sites and clients’ needs.

Check back soon for information on off-grid alternative energy systems.

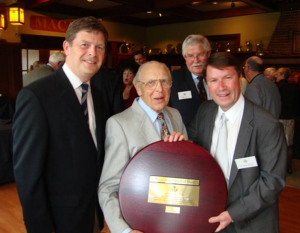

Pemberton Holmes has been providing real estate services in Victoria since 1887. It’s no wonder that traces of the company’s founders are found throughout the community.

An interesting historical side-note the founder of our company J.D. Pemberton and his wife Theresa made some significant donations in their lifetime including the donation of the property used for the Victoria Golf Club. As suchVGC has kindly named the annual service award in honour of the family. Below are a couple of pictures taken from an evening of recognition and celebration enjoyed by approximately 100 Members on Thursday, May 5.

Vincent Holmes, great grandson and Richard Holmes great great grandson were in attendance. Mike Holmes did not attend as he was still worried they might remember him from when he used to sneak on the third tee.

Mr. Keith P. Walker was presented with the first Pemberton Award of Merit. This award recognizes outstanding volunteer service to the Club and its Members.

Keith P Walker with Richard Holmes (left) and Vincent (right) Holmes, great grandson and great great grandson of Joseph D. Pemberton.

Hearing Mayor Dean Fortin address the agents at The Professionals Networking lunch last week was a real treat. As real estate professionals interoffice networking is so important because it allows us to better serve our clients by directly networking their homes listed for sale to dozens of agents. It also gives our buyers a leg up because we’re often first to hear about the hottest listings hitting the market.

In addition to networking at this month’s event, our group was kept abreast of not only real estate activity in Victoria but of what our local officials are doing to make Victoria one of the best places in the world to live.

Among many important topics the mayor discussed how important a vibrant Downtown core is to any major city and highlighted that if the vitality of a city’s downtown was lost that the effects could be devastating and it’s recovery difficult. He cited examples of cities such as Detroit that have taken decades to rebound and restore liveliness to their city centres. To maintain both daytime and nightly patronage of Victoria’s downtown programs like the Clean and Safe project have been successfully implemented and continue to improve.

It truly was great of Mayor Dean Fortin to speak to our group and share his vision for Victoria with us. All of the efforts and developments made by council are too many to list here but more information can be found at www.victoria.ca.

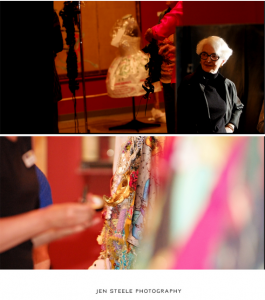

This spring it was my great pleasure to have participated on the planning committee of Art Attire 2011. The wearable art fashion show was a fundraiser for the Art Gallery of Greater Victoria. Providing local textiles and fabric artists the opportunity to showcase their amazing work at the gallery. The show was SPECTACULAR!

This spring it was my great pleasure to have participated on the planning committee of Art Attire 2011. The wearable art fashion show was a fundraiser for the Art Gallery of Greater Victoria. Providing local textiles and fabric artists the opportunity to showcase their amazing work at the gallery. The show was SPECTACULAR!

Now in its second year the event highlights the talents and creativity of local artists and designers.

Now in its second year the event highlights the talents and creativity of local artists and designers.

Thank you to all the artists and volunteers who made this evening a great success and to Jen Steele Photography for taking amazing photos of the night!

Gather your paperwork ahead of time

You’ll be way ahead of other buyers who are scrambling at the last minute. Your real estate agent will be able to let sellers know that you are ready to purchase and this can be a negotiation tool in your favour. Here is a list of paperwork that most lenders will need to approve your mortgage.

Confirmation of down payment

- Savings or investment account statements from within the last 90 days

- Sale of an existing property — a copy of the sale agreement

- If your down payment funds are a gift from your family— a gift letter

- Statement of withdrawal from RRSP through Home Buyer’s Plan

Employment verification:

- Copy of latest 2 pay slips

- T4

- Letter of employment

- T1 General

- Notice of Assessment (NOA)

- If self-employed ask your lender exactly what other information they will need you to provide

As part of the application process, you’ll be asked what some of the projected expenses relating to the property are, such as taxes, heating costs, condo fees, and whether you will be using the property to live in or generate income. You’ll also need to provide a void cheque.

What an amazing weekend spent enjoying the sunshine in a delightful pocket of the city. Sitting on the balcony of our listing at 365 Waterfront was absolute bliss. Beautiful greenery all around, casual walking and biking traffic and not to mention peek-a-boo views of the gorge water way. If it wasn’t for all of the guests that stopped by to visit our stunning new listing I would have forgotten I was working.

365 Waterfront is beyond a doubt one of this city’s gems. The finishes in the building are among the highest quality available and pricing is very reasonable. The finishing features you’ll find include: white oak wide plank flooring, granite counter tops, spa like bathrooms with deep soaker tubs and separate glass encased showers, floor to ceiling windows all in concrete and steel construction. Those marvelous suites that face the water are awe-inspiring but there isn’t a bad spot in the building. If you don’t look onto the water you are overlooking the Galloping goose trail or a beautiful tree lined street.

A modern yet inviting foyer greets entrants into the building and will surely make this hot spot a wonderful place to call home. If your tastes call for only the best quality building materials and a modern clean design with a flow that still invokes that comfy home feeling then 365 Waterfront is perfect! Call us today to arrange a private viewing of this hot spot in Victoria.